Registration open for Taxi & Mobility Update April 19-20, 2018 Brussels

Registration is now open for the sixth Taxi & Mobility Update, which will be held in Brussels on April 19 and 20, 2018 at the Van der Valk Hotel just near Brussels Airport. The key question for this year: ‘Access to the Mobility Market’. Or: Who’s in, who’s out?

You can register here: http://www.mobilityintell.com/registration-update-2018/

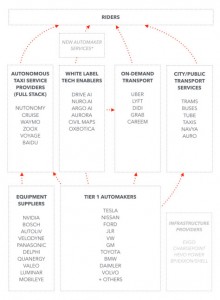

The development of new forms of mobility increasingly throws up many questions and challenges. It is becoming a complicated puzzle with many (potential) stakeholders. Who takes care of the first and last mile or kilometre? Who gets access to the mobility market? Who drives mobility innovation?

Most of the stakeholders involved in these questions, we’re bringing together in Brussels on April 19 and 20, 2018 for an extensive exchange of views and intensive networking sessions. This is your opportunity to join, sponsor and network with a high-level international audience of Taxi and FHV operators, top and middle management, owner-drivers, local, regional and national regulators, government officials, academics, consultants and suppliers.

In previous years around 120 high-level international specialists from all over the world made their way to Amsterdam, where the conference originally started. This year we are expecting at least a 150 highly specialised attendees to come to the Taxi & Mobility Update conference to examine the question who drives tomorrow’s mobility and who gets access to the mobility market.

What can you expect at this annual international English-language mobility conference? You will learn about the latest developments in the Taxi, PHV and mobility world. Get the latest information on:

- Mobility in urban and rural areas

- The latest developments in the automotive world

- Autonomous and connected vehicles

- The cities of tomorrow

- E-mobility and Clean Air initiatives

- The new role of the taxi and FHV industry

At Taxi & Mobility Update 2018 you can address, inform and approach this high-level specialised group of experts about your products and services and, of course, enjoy spring-time in Brussels – a special and surprising destination with much to offer. As a stand-alone conference, running for two days, Taxi & Mobility Update offers many new networking, marketing and PR-opportunities you won’t find at other events..

Network with top speakers and high-level representatives from Europe, USA, Canada, Russia, the Middle-East and many other regions and inform yourself about the latest international Taxi and FHV topics. Communicate with Taxi and FHV operators, regulators, government representatives, trade representatives, consultants and academics and tell them about your products and services. Be ahead of the latest mobility trends.

Don’t miss this great opportunity to contact and inform the opinion leaders in the Taxi PHV and mobility industry! More info? Contact wim.faber@challans-faber.eu

- Registration for Taxi & Mobility Update 2018 is now open: http://www.mobilityintell.com/registration-update-2018/

Interested in last year’s presentations? You’ll find them here:

http://www.mobilityintell.com/taxi-mobility-intell-update-2017-presentations-available/

- This great networking event is only six weeks away!